what is suta tax texas

Texas has state sales tax of. The states SUTA wage base is 7000 per.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

. General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

An employers SUI rate is the sum of five components. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. Assume that your company receives a good assessment and your.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. Lets take the example of Company XYZ which employs ten individuals.

You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Who pays Suta in Texas. The FUTA tax rate is a flat 6 but is reduced to just.

So if you paid an. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. Each of these employees earns an annual taxable income of 10000 bringing the total wages to.

The standard futa tax rate is 60 on the first 7000 of taxable wages per employee which means that the maximum tax that. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the.

Eligibility Benefit Amounts Texas Workforce Commission

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Ui Tax Structure Smarter Taxes American Institute For Full Employment

Which Payroll Data Table Contains The Qtd And Ytd Wages That Are Still Subject To Employer Suta Taxes In Other Words Wages Below The State Maximum Subject To Tax Core Financial

What Are Fica And Futa Employers Resource

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Pay Your Texas Small Business Taxes Zenbusiness Inc

The Complete Guide To Texas Payroll Taxes 2022

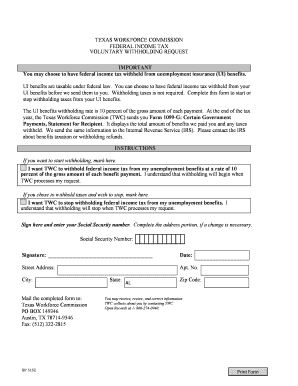

Texas Unemployment Benefits Application Form Fill Online Printable Fillable Blank Pdffiller

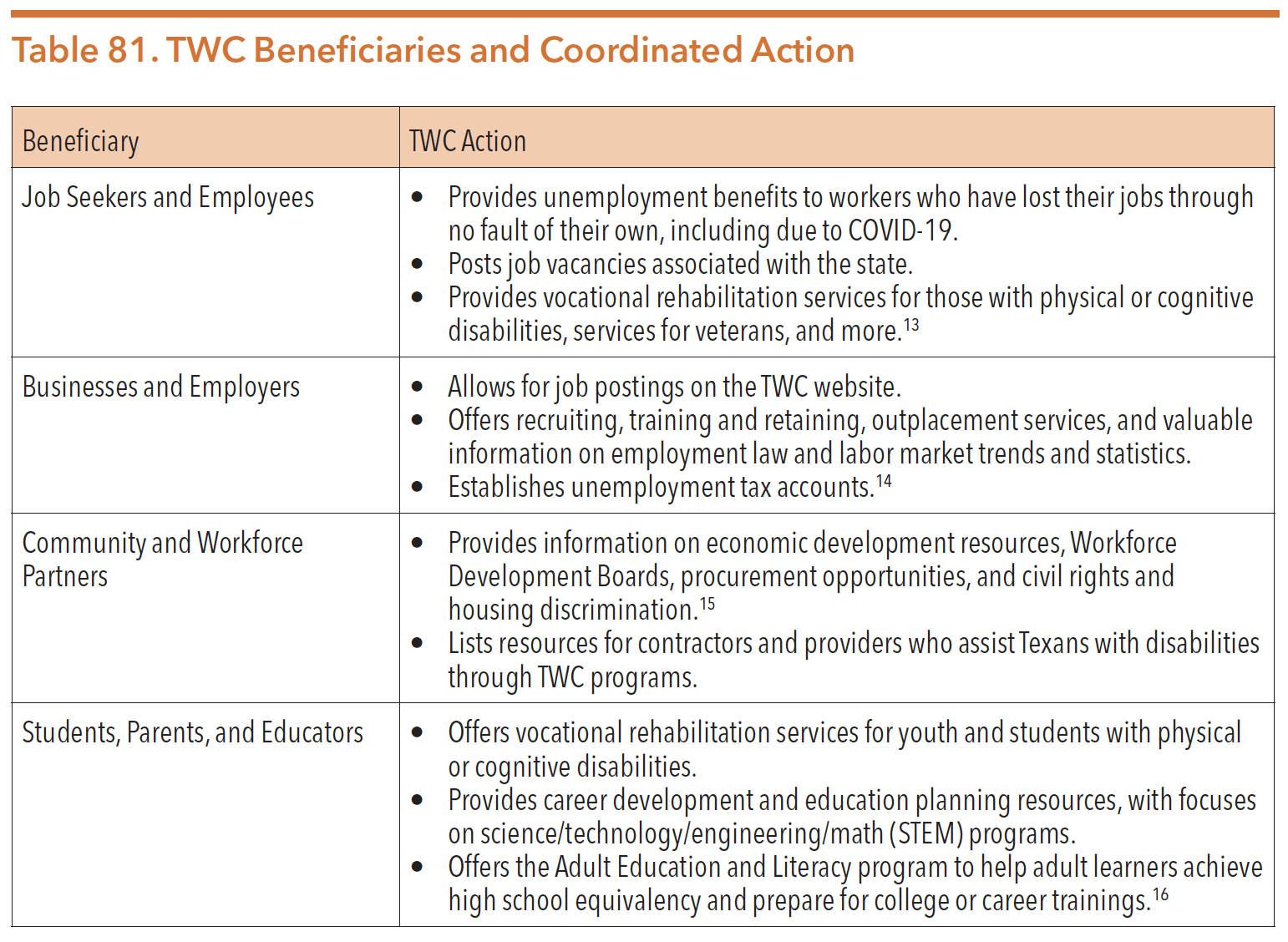

Texas Workforce Commission Hogg Foundation For Mental Health

Twc Expands Skill Enhancements To Ui Claimants Vbr

3 11 154 Unemployment Tax Returns Internal Revenue Service

Payroll Software Solution For Texas Small Business

![]()

Amini Conant Texas Small Business Taxes

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Registration Form Missouri Fill Out Sign Online Dochub

Unemployment Insurance Cost Facts Every Texas Nonprofit Should Know First Nonprofit Companies